- Platform

- Who We Serve

- About Us

FEATURES

A comprehensive toolkit designed to strengthen your firm

Whether you choose to utilize our entire platform or integrate specific modules into your existing system, you will elevate your wealth management capability.

Altafid’s client portal fosters engagement through an intuitive platform, where clients can easily access comprehensive portfolio and performance data in real time.

- Simplified Experience: Clients can effortlessly navigate their portfolio, accessing performance data, allocation breakdowns, and key metrics in a clear and concise format.

- Real-Time Access: View up-to-date statements, performance metrics, and transaction history anytime, ensuring complete transparency.

- Mobile-First Approach: With full mobile app integration, clients can securely access their portfolios from any device, whether they’re at home or on-the-go, ensuring maximum convenience and engagement.

Altafid’s Document Locker provides a streamlined solution for storing and sharing important client documents securely and efficiently.

- Centralized Storage: Organize and secure client data in a single, easy-to-access platform, reducing clutter and improving document retrieval.

- Automated Management: Tailored workflows simplify document handling, with automated reminders and notifications to help firms stay compliant.

- Easy Access & Sharing: Customize permissions for document access, making it easy to search, retrieve, and securely share documents with clients.

Altafid’s reporting platform turns complex data into simple, actionable insights, enabling firms to generate clear and customizable reports.

- Tailored Reports: Produce client-friendly reports that highlight key performance metrics in a simple and understandable format.

- Branded Insights: Deliver professional, branded reports without the need for setup, ensuring consistency and clarity across all communications.

- Real-Time Data: Access live data to generate up-to-date reports, providing clients with accurate performance updates.

Altafid’s comprehensive billing platform automates client billing, ensuring accuracy, flexibility, and transparency.

- Automated Calculations: Eliminate manual errors with precise, automated billing calculations.

- Flexible Methods: Manage different billing structures, including percentage-based, flat fees, and tiered billing models.

- Customizable Invoices: Tailor invoices to clients with clear, detailed breakdowns, offering transparency and ensuring clients are always informed about billing.

- Flexible Commissioning Structures: Manage complex payout scenarios with ease, including customizable advisor splits, program fees, and multi-level tiered structures designed to handle various compensation models.

- Comprehensive Payout Management: Automate commission calculations, track payments, and streamline workflows, ensuring transparency and accuracy across every stage of the process.

Altafid’s integrated trading, rebalancing, and reconciliation solutions streamline portfolio management for advisors. Simplify Tax-Loss harvesting, DCA, and recurring distributions.

- Daily Reconciliation: Identify and correct errors automatically, ensuring portfolio accuracy and minimizing administrative burden.

- Advanced Trading: Leverage a customizable trade blotter, FIX connectivity, different order types, block trading, and monitor liquidity and post-trade allocations to maximize trading efficiency.

- Effortless Rebalancing: Simplify portfolio rebalancing across households, accounts, and portfolios seamlessly with one cohesive platform.

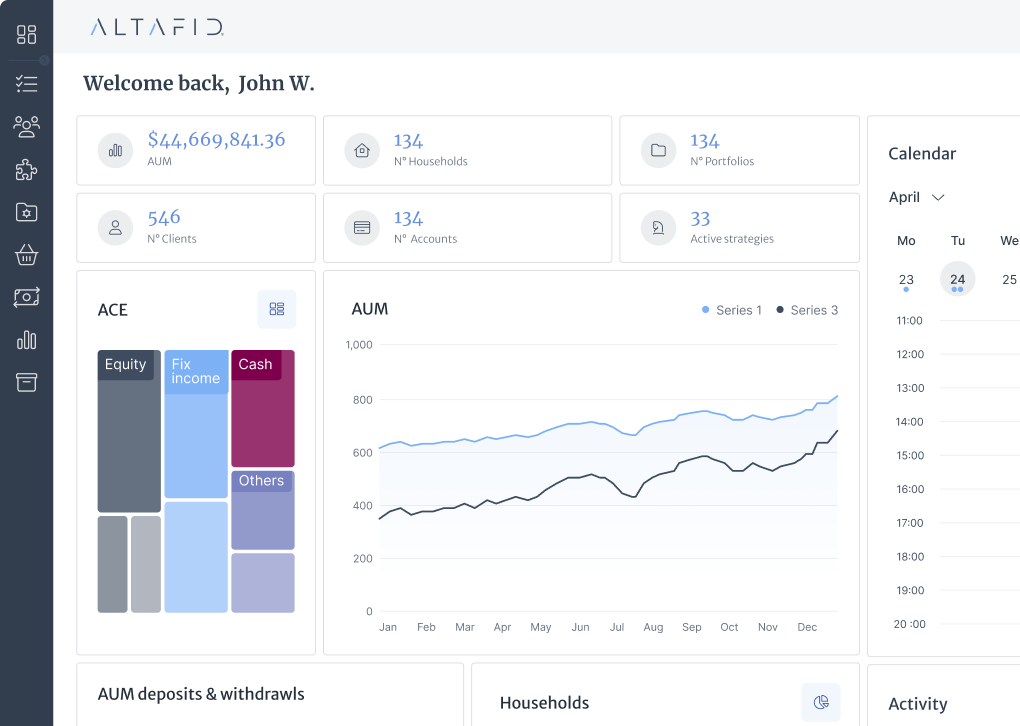

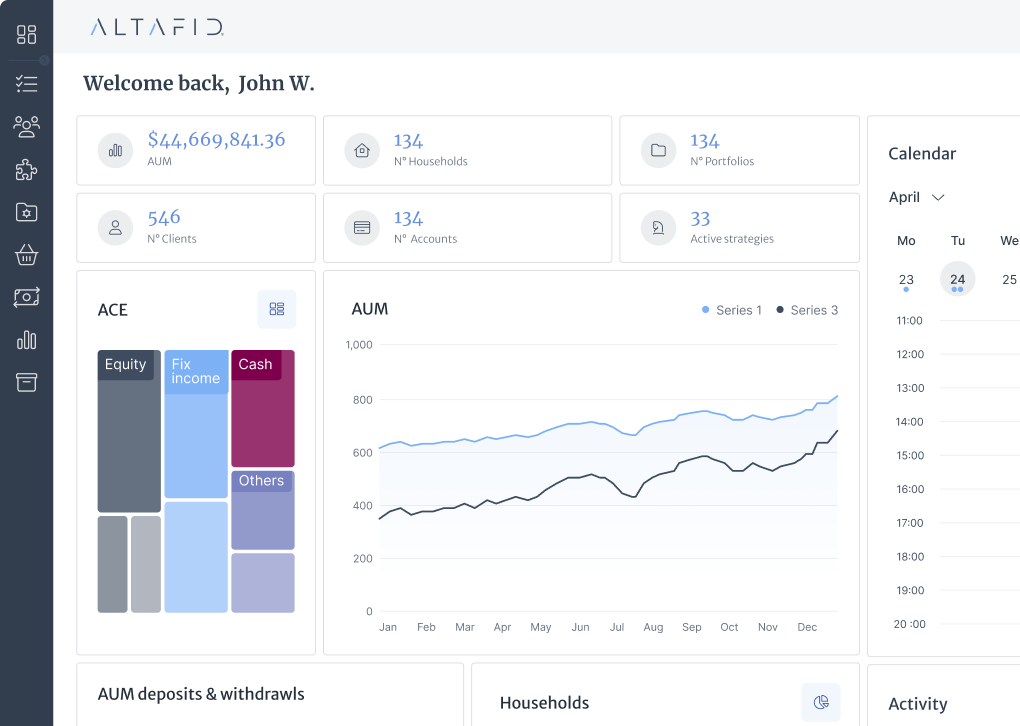

Altafid’s Business Monitor offers real-time insights into business operations, keeping advisors on top of key metrics and updates.

- Timely Notifications: Receive real-time alerts on important events like account setups, cash movements, and other critical activities.

- Comprehensive Dashboard: Access a full overview of business performance through an organized and intuitive dashboard, providing structured insights that guide decision-making.

Altafid’s CRM strengthens client relationships by offering comprehensive data management and communication tools for advisors.

- Comprehensive Profiles: Keep all client data, risk profiles, and portfolios organized in a centralized location for easy access.

- Task Management: Set up tasks, reminders, and to-do lists to stay proactive in client servicing and communication.

- Interaction Tracking: Log client interactions to ensure consistent service and maintain a detailed history of engagement.

Altafid simplifies the onboarding process with streamlined forms and automated workflows that reduce manual errors.

- Multi-Custodial Forms: Compatible with various custodians, Altafid’s onboarding forms minimize data entry and reduce paperwork errors.

- Automated Workflows: Predefined workflows automate administrative tasks, allowing advisors to focus on client relationships while maintaining operational efficiency.

Altafid’s Risk Scoring solution ensures that investments are always aligned with client risk tolerance levels.

- Comprehensive Assessment: Evaluate client risk profiles on both an individual and portfolio level to ensure optimal alignment with investment strategies.

- Real-Time Monitoring: Continuously monitor and adjust risk levels based on real-time data, keeping portfolios aligned with client preferences and market conditions.

Altafid’s portfolio construction tools allow advisors to create tailored models to meet client objectives.

- Pre-Built Models: Access a range of model portfolios designed to meet specific goals, from conservative income strategies to aggressive growth options.

- Blended Strategies: Combine active and passive management approaches to create the optimal balance for each client, maximizing potential returns while managing risk.

- Customize Portfolio Models: Create tailored portfolios aligned with your clients' unique goals and timeframes. Utilize UMA format to finely tune to your client’s objectives and risk tolerance.

Altafid’s compliance management solutions help firms stay ahead of regulatory requirements with automated and real-time reporting tools.

- Automated Reporting: Generate error-free, automated reports that ensure compliance with local and international regulations, saving time and reducing risk.

- Real-Time Monitoring: Proactively identify compliance issues as they arise, reducing the risk of non-compliance and keeping your firm audit ready.

Altafid’s platform provides access to global markets, allowing firms to manage portfolios across multiple currencies and languages.

- Global Securities Access: Invest in both domestic and international markets with real-time data feeds, ensuring accurate and up-to-date insights.

- Multi-Currency Management: Handle multi-currency portfolios with accurate currency valuations and real-time conversion rates, making global investing seamless for clients.

Altafid’s education platform equips clients and advisors with the knowledge needed to make informed decisions and stay up-to-date with financial markets.

- Client Learning: Provide clients with access to educational resources, including market insights, tutorials, and personalized learning paths, empowering them to better understand their portfolios and investment strategies.

- Advisor Training: Offer advisors continuous professional development with access to courses and certifications, ensuring they remain experts in their field.